Quick estimate tax return

There is an automatic 100 fine if you submit your tax return after the deadline and the penalties go up over time. Use our tax return calculator to estimate your tax refund.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

The fastest way to get your tax done.

. This marginal tax rate means that. Use Quick Pay online no log-in needed. No Need to visit our office.

Online License No Tax Due System. You may also face late fines on any tax payment you owe that is overdue. Make estimated payments directly to the Tax Commission Use Form 51 Estimated Payment of Idaho Individual Income Tax or.

Military No Return Required. Total of Quarterly self-assessment tax payments made 180000 Discount 200000 x 10 already deducted 20000 Balance Tax payable on or before September 30 2017. Pay the tax you owe.

Your average tax rate is 1198 and your marginal tax rate is 22. Use this free tax return calculator to estimate how much youll owe in federal taxes using your income deductions and credits in just a few steps. Etax fees are tax deductible.

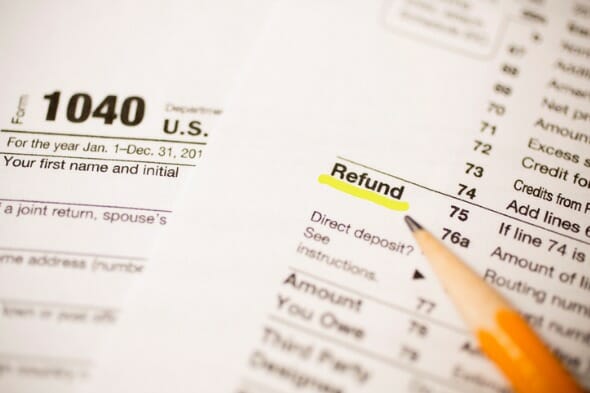

Complete your tax return online in under 10 minutes. Return Refund Checks. Our quick and simple mileage tax calculator will give you an instant estimate of how much you can claim back from HMRC for.

Individual Income Tax Calculator. Use our free tax rebate calculator for an instant estimate of how much tax refund you could be owed. Use our crypto tax calculator to estimate your capital gains tax.

If you make 70000 a year living in the region of Michigan USA you will be taxed 11154. Estimate your tax refund with HR Blocks free income tax calculator. Pay Business Taxes Online.

Fast Etax Returns start from 7090 Australias favourite online tax return service improved again this year with better tax-saving features and support. To lodge online with myTax you will need a myGov account with an active link to the ATO. The value of a.

Do My Tax Online. Pay the tax on or before April 15. Estimate your tax on the income.

Prepare and lodge your own tax return online it is the quick safe and secure way to lodge most process in 2 weeks. Additions to Tax and Interest Calculator. ReceiptHub Manage and organise your receipts throughout the year with.

If you miss the deadline file your tax return as soon as possible to avoid fines building up. Whether its one day or five days a week well tailor our service to suit your needs. If declaration as well could maintained online or support offline PDF document with save option at initial stage to estimate refund instead of sending out hard copies to avoid corrections.

Whats the fine if I dont lodge a tax return. Prepare for a quick and efficient tax return experience with our checklist. E-File FederalState Individual Income Tax Return.

Because it makes the tax-prep process. Total Income Tax payable for the YA 201617. Use the 2019 income tax rate schedule to estimate the total tax youll owe.

Quick to complete and carefully checked by our experts. Check Your Return Status. Online application to prepare and file IFTA Quarterly Fuel Tax return for Texas TX State with ExpressIFTA.

FAQs Have your circumstances changed. Search our frequently asked questions to find more about Tax and other relevant information. If youre self-employed or using the Self-Assessment tax return system for other reasons.

Its never been easier to calculate how much you may get back or owe with our tax estimator tool. Etax fees are also shown in a table at the signing final page of your tax return together with your tax refund estimate. Let us help you turn this into an IRS acceptance.

The average is 3k. A simple tax return excludes self-employment income Schedule C capital gains and losses Schedule D rental and royalty income Schedule E farm income Schedule F. Avoid IFTA Audit by preparing IFTA document.

Firstly the ATO will issue you a Failure To Lodge FTL penalty if your tax return isnt lodged by the due date. See an estimate and breakdown of your refund or debt tax owing. Latest news and advice on mortgage loans and home financing.

You can also login to our online service for. Well make your annual tax return as easy as possible and ensure that you claim any tax allowances that can be offset against your tax expenses. This fine is calculated at the rate of one penalty unit for each period of 28 days or part thereof that the document is overdue up to a maximum of five penalty units.

The Owner Operator S Quick Guide To Taxes Truckstop Com

How Long Does It Take To Get A Tax Refund Smartasset

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Do I Need To File A Tax Return Forbes Advisor

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Turbotax Vs H R Block Which Online Tax Service Is Best

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

California Tax Forms H R Block

Quarterly Tax Calculator Calculate Estimated Taxes

Excel Formula Income Tax Bracket Calculation Exceljet

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

What Is Schedule A H R Block

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Year 2022 Calculator Estimate Your Refund And Taxes

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Tax Credit Definition How To Claim It